An Essex County accountant is facing criminal charges after authorities claim he stole more than $1.6 million from a longtime client and the client’s two businesses, with some of the funds reportedly used for personal expenses such as sports betting. On January 28, New Jersey’s Acting Attorney General Jennifer Davenport and the Division of Criminal Justice announced the accusations.

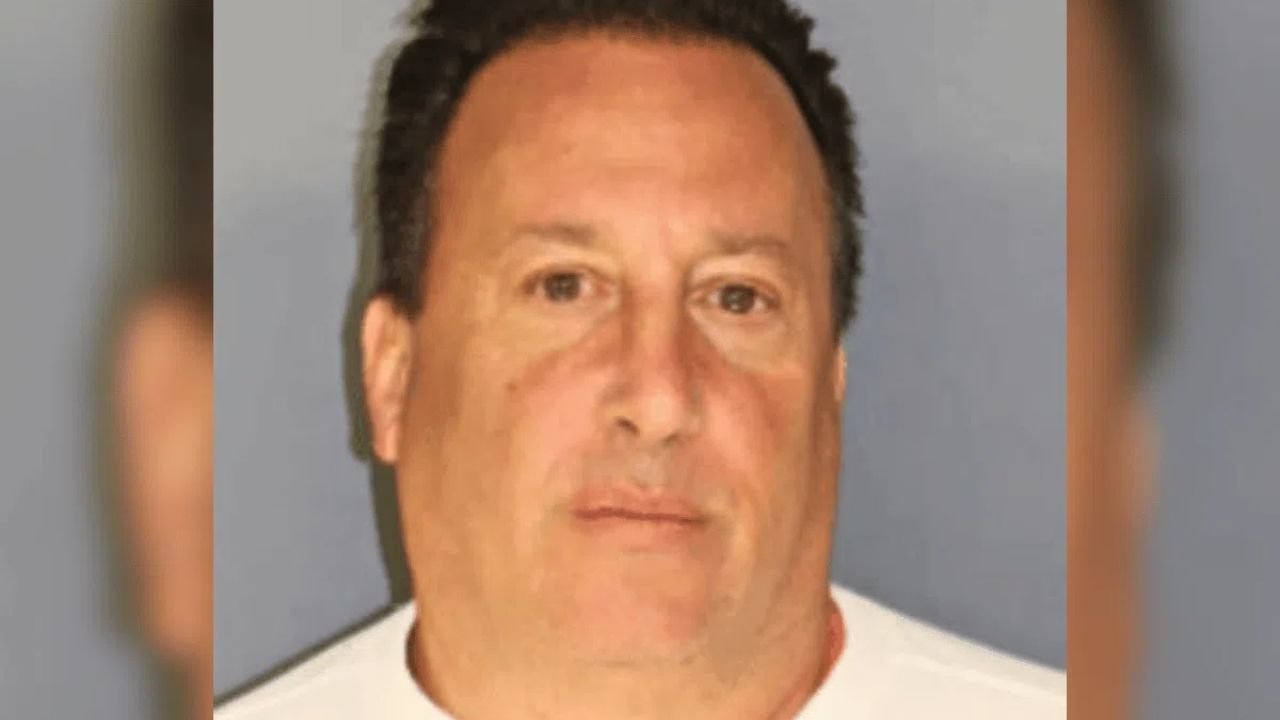

Michael Delia, 61, of West Orange, faces two counts of second-degree theft by unlawful taking, one case of second-degree money laundering, and one count of refusal to turn over collected taxes, according to state officials.

“Our business owners should be able to trust their hired professionals to help them run their businesses responsibly and legally,” Acting Attorney General Davenport said. “The defendant in this case is accused of violating his trust as the accountant and bookkeeper for two companies, lining his pockets at their expense and at the expense of the people of New Jersey. This conduct will be prosecuted to the fullest extent of the law.”

“This defendant is charged with stealing from his client, laundering the stolen money, and then diverted collected taxes from and owed to the state of New Jersey,” DCJ Director Theresa L. Hilton said. “Our office will continue to prosecute white collar cases like this as the serious crimes that they are.”

Essex County accountant allegedly steals to fund sports betting and other personal expenses

Prosecutors allege that from 2016 to August 9, 2023, Delia exploited his employment as an accountant and bookkeeper for a local business owner to steal approximately $1.64 million from two firms owned by that client. Authorities suspect that he diverted company funds into personal and business bank accounts under his control.

According to a financial review, Delia allegedly spent the money on personal expenses such as credit card debt, sports betting, mortgage payments, and other things. From January 2020 to July 2023, investigators claim he transferred $910,545 in collected sales taxes and other revenue into his accounts, money he was not permitted to spend.

Prosecutors also believe that Delia issued business checks for himself that exceeded his agreed-upon remuneration, resulting in an additional $733,313 in stolen funds.

As the company’s accountant and bookkeeper, Delia was in charge of making sales tax payments to the New Jersey State Treasury. Authorities allege that in 2023 alone, he stole more than $126,258 owed to the state and instead directed it to his own company, STP Processing, which he established in 2013.

Attorney General Davenport praised the Division of Criminal Justice, the Division of Taxation’s Office of Criminal Investigation, and the U.S. Small Business Administration’s Office of the Inspector General for their assistance with the case. Delia was detained with the assistance of officials from the Port Authority of New York and New Jersey.

Conner Ouellette, DCJ’s Deputy Attorney General, is handling the case.

Second-degree crimes in New Jersey can result in a five- to ten-year state prison sentence and up to $150,000 in fines.

As with any criminal cases, they are merely allegations, and Delia is deemed innocent unless proven guilty in court.

Leave a Reply